What Is a Financial Analyst? A Complete Guide

Jul 17, 2024

Ever wondered, “What does a financial analyst do?” A financial analyst acts as a vital compass in various industries. Their insights

shape strategic planning and investment choices, driving companies toward financial

success and stability, ensuring informed, forward-thinking decisions in a dynamic

business landscape.

But that’s not all. In this blog post, we explore what is a financial analyst, their skills and qualifications, and opportunities for advancement. Understanding what makes a good financial analyst is crucial for getting ahead.

Key Responsibilities and Duties of a Financial Analyst

A financial analyst examines financial data to monitor and assess companies' financial health and ensure regulatory compliance. As such, these professionals analyze financial statements, market trends, and economic conditions to predict future performance. From liquidity and growth to profitability and variance, they conduct various types of financial analysis. Additionally, they prepare detailed reports and presentations, offering recommendations for investments, budgeting, and cost management.

A vital component of a financial analyst’s job is to collaborate with departments to develop economic strategies, assist in risk management, and support financial projects. The role requires strong analytical and communication skills for translating complex data into actionable insights, helping businesses optimize their operations and achieve their goals. It also requires attention to detail, critical thinking, and working under pressure.

The lack of a financial analyst can severely impact companies. Without their expertise, businesses may struggle with financial planning and forecasting, leading to poor investment decisions and budget mismanagement. This can result in financial instability, missed opportunities, and regulatory non-compliance.

Skills and Qualifications

Financial analysts face difficult challenges in their daily tasks, necessitating a strong skillset and educational background. This ensures they can accurately complete their duties and promote company growth.

Education Requirements

To become a financial analyst, a bachelor's degree in finance, accounting, economics, or business administration is typically required, providing a foundational understanding of financial principles and management. A master's degree, often in finance or an MBA (Master of Business Administration), offers advanced knowledge and skills, enhancing job prospects and career growth.

Other opportunities for advancement include:

Certifications:

- CFA (Chartered Financial Analyst): The CFA credential is highly respected and focuses on investment management and analysis. It requires passing three rigorous exams covering ethics, economics, portfolio management, and securities analysis. The CFA designation is valuable for asset management, investment research, and financial advisory roles, demonstrating a deep understanding of financial markets and high ethical standards.

- CPA (Certified Public Accountant): The CPA designation is essential for those specializing in accounting and auditing. It requires passing the Uniform CPA Examination and meeting state-specific education and experience requirements. CPAs are experts in financial reporting, tax preparation, and compliance, making them crucial for ensuring accurate financial records and adherence to regulations.

- CFP (Certified Financial Planner): The CFP credential is useful for those working in financial planning and advising. It involves completing coursework, passing a comprehensive exam, and meeting experience and ethical requirements. CFPs are skilled in retirement planning, estate planning, tax strategies, and investment management, providing holistic financial advice to individuals and families.

Training Programs:

- Internships and entry-level positions offer hands-on experience and practical skills. They are also crucial for networking and sharing experiences with professionals in the field.

- Continuing education courses and workshops help stay updated with industry trends and regulatory changes. In the ever-evolving business landscape, being up-to-date is essential for success.

These educational pathways equip financial analysts with the knowledge and skills necessary to tackle complex financial challenges effectively.

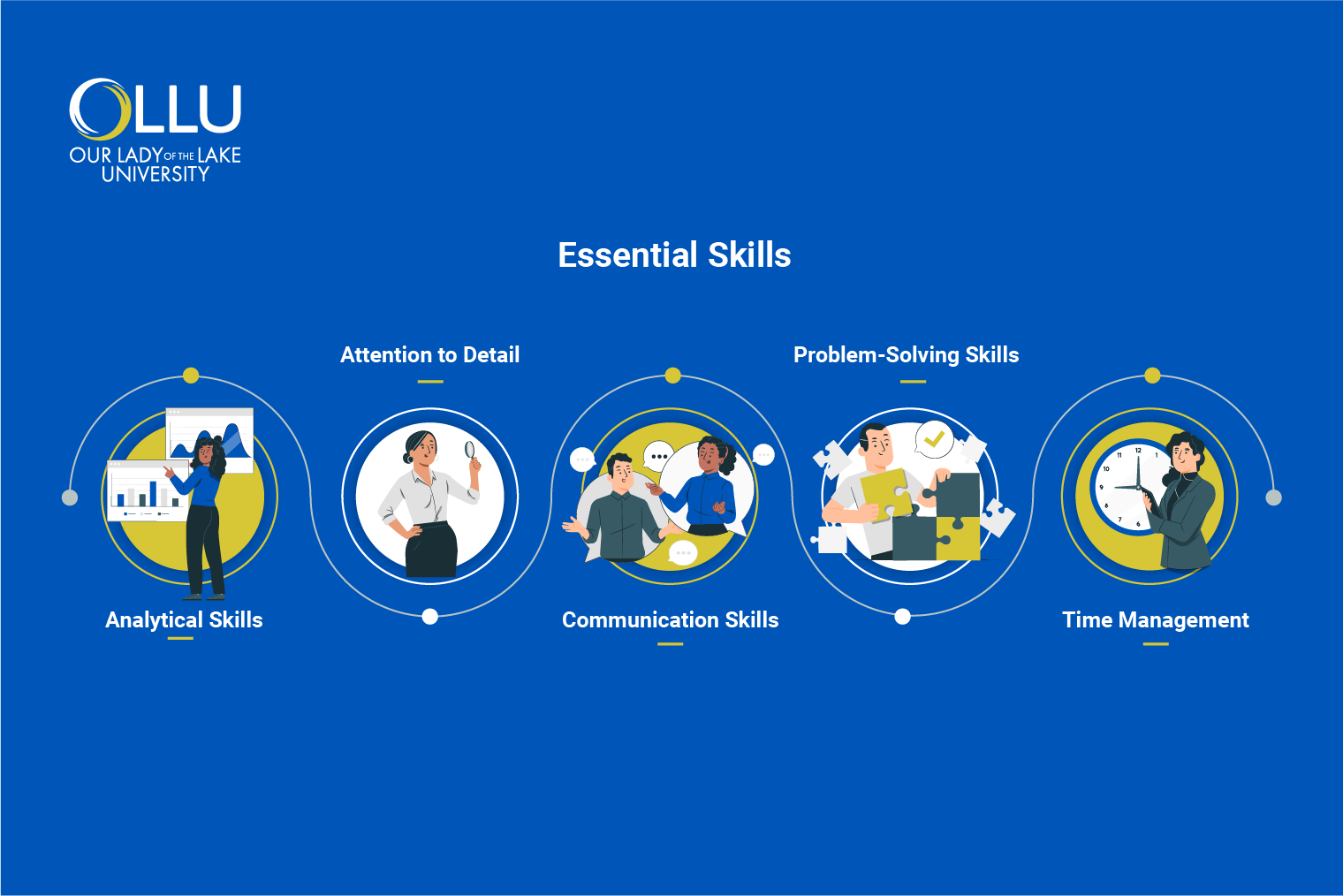

Essential Skills

A financial analyst plays a crucial role in evaluating financial data to help businesses

make informed decisions. As such, they require a combination of technical and soft

skills to succeed in their roles.

- Analytical Skills: Financial analysts must interpret complex data to identify trends and insights. This involves using statistical techniques and financial models to make sense of large datasets, allowing them to predict future performance and make recommendations.

- Attention to Detail: Accuracy is crucial in financial reporting and analysis. Minor errors can lead to significant financial missteps, so analysts must meticulously check their work to ensure precision in their calculations and reports.

- Communication Skills: Presenting findings and recommendations clearly is essential. Analysts need to convey complex financial information to stakeholders, including executives and clients, often through reports, presentations, and meetings.

- Problem-Solving Skills: Developing solutions for financial challenges is a key part of the role. Analysts must think critically to address issues such as market volatility, investment risks, and financial planning strategies.

- Time Management: Handling multiple tasks and meeting deadlines efficiently is vital. Financial analysts often work on several projects simultaneously and must prioritize their workload to complete tasks on time while maintaining high-quality work.

These skills enable financial analysts to perform their duties effectively and support business growth.

Technical Skills

Besides a strong command of soft skills, a financial analyst needs various technical skills to efficiently handle their responsibilities and analyze financial data. These skills include:

- Excel Proficiency: Creating and managing complex spreadsheets for data analysis

- Financial Software: Using tools like Bloomberg Terminal, QuickBooks, or SAP for financial reporting

- SQL Knowledge: Extracting and manipulating data from databases

- Data Visualization: Using software to create insightful charts and graphs

- Statistical Analysis: Applying statistical methods to interpret financial data

- Programming Skills: Basic knowledge of programming languages like Python or R for automating data analysis tasks

These technical skills enable financial analysts to effectively process and analyze financial data, leading to better decision-making and strategic planning.

Job Outlook and Salary

The labor market for financial analysts seems promising, with an expected growth in demand. Financial analyst employment is expected to grow by 8% in the following decade, with around 24,700 job openings becoming available each year.

Financial and investment analysts can expect to earn an average annual salary of around $99,000. This figure can vary based on factors such as experience, education, and location. With additional certifications and advanced degrees, analysts can see significant salary increases. For instance, the salary for those working in securities, commodity contracts, and other financial investments and related activities averages $115,480 per year.

This field values expertise and performance, providing ample opportunities for salary growth and career advancement for dedicated professionals.

Potential Career Paths

Financial analysts typically start in entry-level positions such as junior analyst or research assistant. In these roles, they learn to analyze financial data, create reports, and support senior analysts. These are jobs that give analysts a chance to be introduced to the duties and responsibilities of the role, helping them form a solid foundation of knowledge in financial analysis. As they gain experience and demonstrate their skills, they can move up to more advanced FP&A careers, such as:

- Senior Analyst: With experience, analysts can advance to senior positions, where they take on more complex projects and lead junior analysts.

- Portfolio Manager: Managing investment portfolios, making strategic decisions to achieve financial goals, and working closely with clients.

- Financial Manager: Overseeing financial activities of a department or company, including budgeting, forecasting, and reporting.

- CFO (Chief Financial Officer): The top financial executive in a company, responsible for all financial operations, strategy, and risk management.

- Investment Banker: Advising companies on mergers, acquisitions, and raising capital.

Each of these roles offers increasing levels of responsibility, leadership, and the potential for higher earnings. By gaining experience, pursuing advanced education, and obtaining certifications, financial analysts can progress through these career paths and achieve significant professional growth.

Tips for Advancing in the Field

Financial analysis is a highly competitive field, which imposes the need for personal growth and advancement. Certain factors can help you become a league above the rest, ensuring a satisfactory position in a company and enjoying lucrative benefits.

- Continuous Learning: Stay updated with industry trends and pursue advanced degrees or certifications like CFA, CPA, or MBA.

- Gain Experience: Seek diverse roles and projects to broaden your skills and knowledge base.

- Networking: Build professional relationships through industry events, seminars, and online platforms like LinkedIn.

- Seek Mentorship: Learn from experienced professionals who can offer guidance and support.

- Set Career Goals: Define clear objectives and create a plan to achieve them, regularly assessing your progress.

Focusing on these details is key to not only landing a job in the field but also establishing a name for yourself.

Conclusion

Financial analysts are essential for evaluating financial data and guiding business decisions, making them crucial for company growth. It is a role that requires background education in finance, business administration, or accounting combined with a repertoire of certifications and experience in the field. With key skills like analytical thinking, attention to detail, and clear communication, financial analysts can progress to senior roles such as portfolio manager or CFO, with promising salary prospects.

Explore opportunities in this dynamic field to advance your career and achieve professional growth. Start by discovering the Master in Accounting degree and the Master in Financial Analysis at OLLU for a promising future!

Frequently Asked Questions (FAQs):

What does a financial analyst do?

A financial analyst evaluates financial data to help businesses make informed decisions. They analyze financial statements, market trends, and economic conditions to forecast future performance and provide investment recommendations.

What qualifications are needed to become a financial analyst?

A bachelor's degree in finance, accounting, economics, or business administration is typically required to become a financial analyst. Advanced certifications like CFA or CPA and a master's degree can enhance career prospects.

What is the average salary of a financial analyst?

The average annual salary of a financial analyst is around $99,000, with potential for higher earnings based on experience, education, and advanced certifications.