How to Become a Financial Analyst?

Jul 25, 2024

Becoming a financial analyst is not just about numbers; it's about mastering the art of interpreting financial data to guide crucial business decisions. Financial analysts are pivotal in the corporate landscape by meticulously dissecting economic trends, assessing investment opportunities, and forecasting future financial performance. Their insights are instrumental in helping businesses navigate uncertainties, optimize resource allocation, and achieve sustainable growth.

The objective of this guide is to clarify and simplify the journey to becoming a financial analyst, offering a step-by-step approach that covers essential skills, educational requirements, and practical tips necessary to thrive in this dynamic profession. Whether you're starting from scratch or looking to advance your career, this guide equips you with the knowledge needed to excel in finance.

What Is a Financial Analyst?

A financial analyst evaluates financial data, prepares reports, and provides insights and recommendations to aid businesses and individuals in making sound investment decisions. There are different types of financial analysts, including investment analysts, who focus on stocks, bonds, and other securities; risk analysts, who assess the financial risks associated with investment opportunities; and portfolio managers, who oversee and optimize investment portfolios. Financial analysts are employed across a wide range of industries, such as banking, insurance, investment firms, and corporate finance departments, playing a pivotal role in guiding financial strategies and ensuring the economic stability of their organizations.

What Does a Financial Analyst Do?

The main duties of a financial analyst include examining financial data and trends to offer key insights and recommendations. They meticulously examine financial statements, market trends, and economic data to assess the performance and potential risks of investments. This analysis forms the basis for preparing detailed reports and presentations that aid stakeholders in making informed decisions about investment strategies, budgeting, and financial planning.

Financial analysts serve as key advisors in the decision-making process, offering expert opinions and forecasts based on their rigorous analysis. For instance, on a typical day, a financial analyst might start by reviewing quarterly financial statements, conducting a comparative analysis of industry peers, and preparing a presentation for senior management outlining potential cost-saving measures or investment opportunities. Their role demands meticulous attention to detail, robust analytical abilities, and the skill to clearly convey intricate financial information to stakeholders at every organizational level.

How to Become a Financial Analyst?

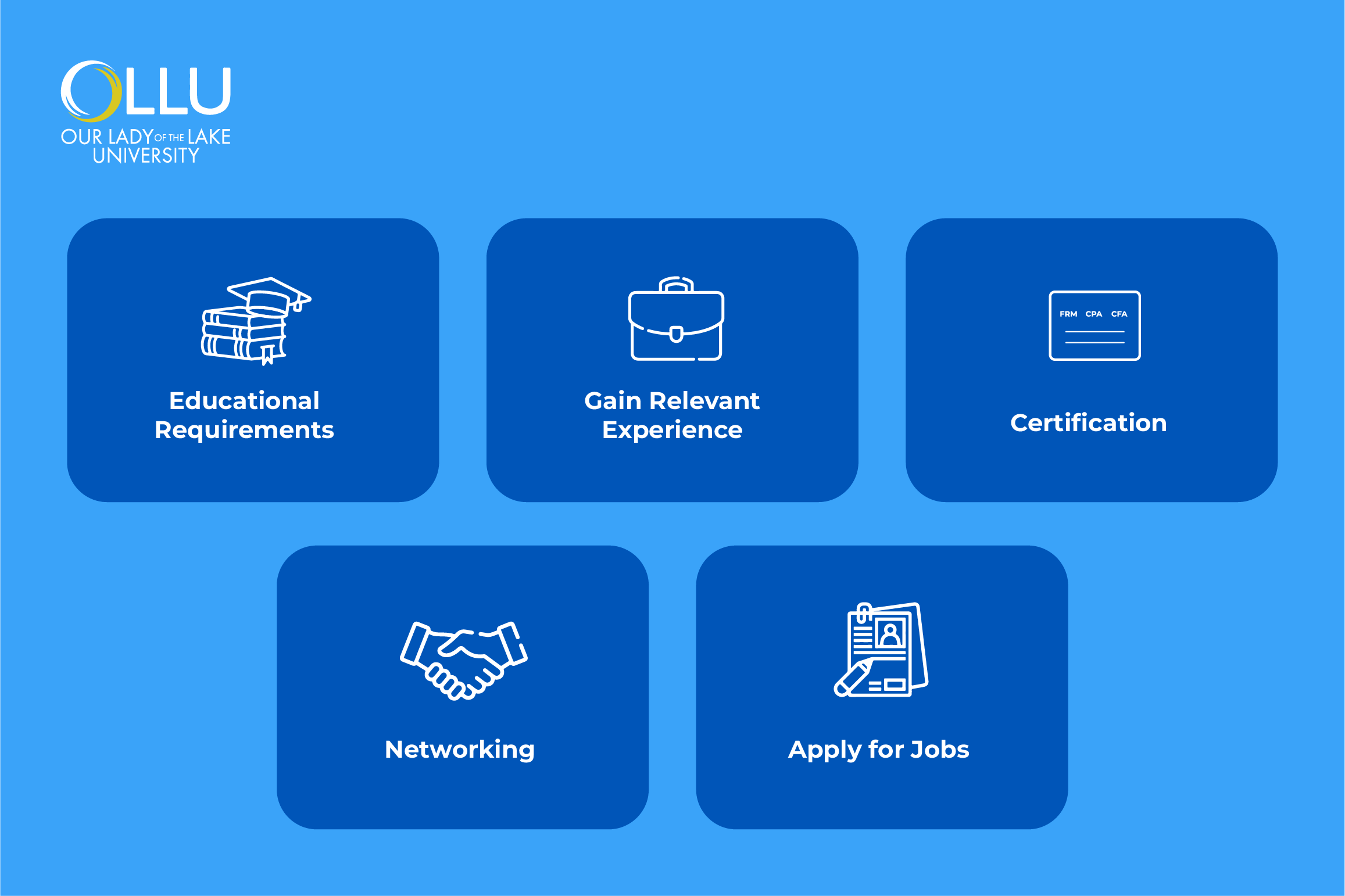

Becoming a financial analyst involves a structured pathway that typically includes meeting specific educational requirements, acquiring relevant skills, and gaining practical experience. This guide will outline these steps in detail, providing a comprehensive roadmap for aspiring financial analysts. From pursuing the right educational background to honing analytical and communication skills, each stage is crucial in preparing aspiring individuals for success in this dynamic and competitive field.

The following paragraphs will explore each step in detail, providing practical guidance and insights to help you on your path to becoming a financial analyst.

1. Educational requirements

A bachelor's degree is a foundational requirement for aspiring financial analysts, offering essential knowledge and skills vital to understanding financial markets, economic principles, and quantitative analysis techniques. Degrees in finance, economics, accounting, or related fields provide a solid academic background, equipping individuals with proficiency in financial modeling, statistical analysis, and financial statement analysis.

While a bachelor's degree is typically sufficient to enter the field, pursuing advanced degrees such as a Master of Business Administration (MBA) with a focus on finance or an Online Master's in Financial Analysis can enhance career prospects and deepen expertise in specialized areas of financial analysis. Advanced degrees often include coursework that delves into advanced financial theories, strategic financial management, and global financial markets, preparing individuals for more senior and specialized roles in financial analysis.

2. Gaining relevant experience

Acquiring relevant experience is essential for becoming a successful financial analyst, as practical experience complements academic knowledge and hones analytical skills. Internships and entry-level positions, such as financial analyst intern, junior analyst, or research assistant, provide valuable opportunities to apply theoretical knowledge to practice, learn industry-specific software, and develop professional networks. These roles often involve tasks such as collecting and analyzing data, financial modeling, and assisting in preparing reports and presentations.

Leveraging this work experience for career growth involves actively seeking mentorship, demonstrating analytical acumen, and continuously updating one's skill set to adapt to evolving financial tools and market conditions. Progressing from entry-level to more advanced positions often requires showcasing a proven track record of insightful analysis and decision-making, making these early career experiences indispensable for long-term success as a financial analyst.

3. Certifications

Certifications are pivotal in advancing a financial analyst's career by validating expertise and enhancing credibility in the field. Key certifications include the Chartered Financial Analyst (CFA), Financial Risk Manager (FRM), and Certified Public Accountant (CPA).

The CFA certification, renowned globally, focuses on investment management and financial analysis, offering comprehensive knowledge in areas such as equity analysis, portfolio management, and ethical standards. The FRM certification specializes in risk management, equipping professionals with skills to identify and manage financial risks. While traditionally associated with accounting, the CPA certification is highly beneficial for financial analysts involved in corporate finance and financial reporting.

Obtaining these certifications requires passing rigorous exams, meeting professional experience requirements, and demonstrating high competency and dedication to the field. These certifications enhance job prospects and potential earnings and provide a competitive edge in the dynamic financial industry.

4. Networking

Networking is crucial to a financial analyst's career development, as building professional connections can lead to job opportunities, mentorship, and industry insights. By becoming a member of professional associations like the CFA Institute, Financial Planning Association (FPA), or local finance clubs, you can access valuable resources, attend industry events, and connect with a community of like-minded professionals.

Effective networking strategies include attending industry conferences, participating in webinars, and engaging in online platforms like LinkedIn. Building a robust LinkedIn profile, actively participating in discussions, and connecting with various industry professionals can enhance visibility and open doors to career advancement.

Networking is about establishing connections and fostering meaningful relationships by engaging in regular interactions, offering mutual support, and staying updated on industry trends. By leveraging these networks, financial analysts can gain insights, find new opportunities, and achieve long-term career success.

5. Applying for jobs

The field of financial analysis requires a strategic approach to stand out in a competitive market. Effective job search strategies include utilizing job boards like LinkedIn, Indeed, and Glassdoor and exploring company websites and finance-specific recruitment platforms. Submitting a tailored resume and cover letter is essential. Highlight relevant education, certifications, and experience and emphasize specific achievements and skills pertinent to financial analysis. Customizing these documents for each application can significantly increase your chances of getting noticed.

Additionally, thorough interview preparation is crucial. Research the company, understand its financial landscape, and practice common interview questions. Preparing to discuss your analytical skills, past projects, and how you can contribute to the company's financial goals will demonstrate your readiness and suitability for the role. Through diligent job searching, personalized applications, and rigorous interview preparation, aspiring financial analysts can effectively navigate the job market and secure promising positions.

Financial Analyst Skills

Success as a financial analyst hinges on mastering diverse key skills, including analytical, technical, and communication abilities.

Analytical skills are fundamental, enabling analysts to interpret complex financial data, identify trends, and make data-driven recommendations. Technical skills, such as proficiency in Excel, financial modeling software, and data analysis tools, like SQL or Python, are essential for efficient and accurate financial analysis. Communication skills are equally important, as analysts must convey complex financial insights clearly and persuasively to stakeholders through reports and presentations.

You can develop all or the majority of these skills through formal education, certifications, practical experience, and continuous learning via workshops and online courses. In practice, these skills come together when an analyst evaluates a company's quarterly performance, creates a detailed financial model projecting future earnings, and presents their findings to senior management to inform strategic decisions. By honing these skills, financial analysts can effectively contribute to their organization's financial success and strategic planning.

Salary and Job Outlook

The salary and job outlook for financial analysts are highly promising, reflecting the profession's critical role in the business landscape. In May 2023, financial and investment analysts had a median annual wage of $99,010, according to the Bureau of Labor Statistics. Factors influencing salary include location, financial hubs like New York and San Francisco offering higher compensation, experience, and education level, and advanced degrees and certifications potentially leading to increased earnings.

The job outlook for financial analysts is robust, with an anticipated growth rate of 8% from 2022 to 2032, outpacing the average for all occupations. This growth is fueled by the growing complexity of financial markets and the escalating need for in-depth financial analysis in various industries. Consequently, the demand for skilled financial analysts remains high, offering ample career advancement opportunities for those who continuously enhance their skills and expertise.

Conclusion

In conclusion, becoming a financial analyst is a rewarding journey that requires a blend of education, relevant experience, certifications, and networking. Key points to remember include obtaining a solid academic foundation in finance or a related field, gaining hands-on experience through internships and entry-level job positions, and pursuing valuable certifications such as CFA, FRM, or CPA. Developing essential analytical, technical, and communication skills is crucial for success, as is effective job searching and interview preparation.

With a promising salary and job outlook, the financial analysis field offers substantial growth and advancement opportunities. Aspiring financial analysts are encouraged to stay proactive in their learning, seek mentorship, and build a professional network. By following the outlined steps and continuously enhancing your skills, you can successfully navigate the path to becoming a financial analyst.

Frequently Asked Questions

Which qualification is best for a financial analyst?

A bachelor's degree in finance, economics, or accounting is typically the starting point for an aspiring financial analyst. Advanced qualifications such as a CFA (Chartered Financial Analyst) or MBA enhance career prospects even further.

Do financial analysts need CFA?

While not always required, a CFA designation is highly valued in the industry for demonstrating advanced investment analysis and portfolio management knowledge.

Is a financial analyst a good career?

Yes, financial analysts play a crucial role in helping businesses make informed financial decisions. It offers competitive salaries, strong job growth, and opportunities for advancement in various industries.