Key Insights on Financial vs. Managerial Accounting

Dec 09, 2024

Financial accounting and managerial accounting are two of the largest branches of

the profession. Despite many similarities in approach and usage, there are significant

differences, most centering around compliance, accounting standards, and target audiences.

Financial accounting and managerial accounting are two of the largest branches of

the profession. Despite many similarities in approach and usage, there are significant

differences, most centering around compliance, accounting standards, and target audiences.

Accounting is the backbone of every business. It helps with making decisions, following rules, and tracking the business's performance. But not all accounting is the same. Two key branches—financial accounting and managerial accounting—serve distinct purposes.

This blog explores the core differences between financial vs managerial accounting. By understanding these differences, you'll be better equipped to decide which career in accounting is right for you.

Definition and Purpose of Financial and Managerial Accounting

In simple terms, financial accounting reports externally on an organization's transactions and financial health. On the other hand, managerial accounting helps with strategic decision-making and financial processes within an organization.

Let’s break down the basics.

Financial Accounting

Financial accounting, a crucial aspect of business operations, primarily concerns financial information reporting to external stakeholders, such as investors, regulators, and creditors. There are strict rules to follow, like Generally Accepted Accounting Principles (GAAP) or International Financial Reporting Standards (IFRS). The goal is to show a clear financial picture of the company over a specific time, like every three months or once a year.

You might encounter financial accounting in case studies during classes or internships, where companies' financial reports are analyzed to evaluate performance. Student clubs like the Accounting Society often have workshops and events to help you understand these principles better.

Managerial Accounting

Managerial accounting, a key tool for internal decision-making, focuses on providing information to internal stakeholders—company managers and executives. It deals with budgeting, forecasting, and performance analysis. Unlike other types of accounting, there aren't strict rules for how the information has to be presented, so there's more flexibility.

As students, you might come across managerial accounting when you're working on business projects at school where you need to figure out costs and create budgets for them. Internships can also expose you to how businesses allocate resources and analyze their operations.

Key Differences Between Financial and Managerial Accounting

Here are some key differences between financial accounting and managerial accounting:

Here are some key differences between financial accounting and managerial accounting:

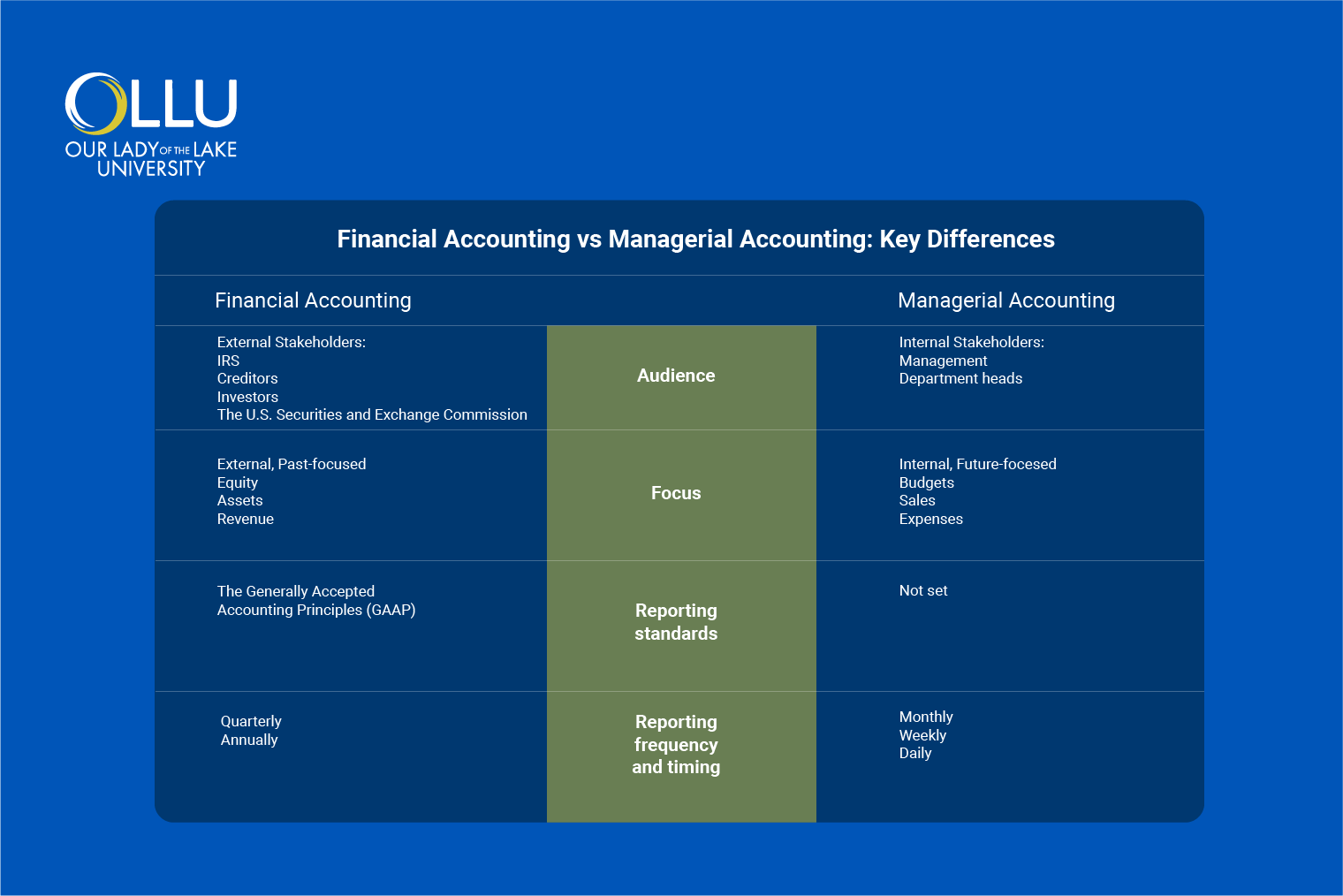

Audience

Financial accounting focuses on creating standardized financial statements that help external stakeholders understand how the company is doing financially. These external stakeholders include:

-

IRS

-

Creditors

-

Investors

-

The U.S. Securities and Exchange Commission

Managerial accounting focuses on providing detailed information to internal stakeholders —like management and department heads—who need detailed and actionable information to make strategic planning and operational decisions.

Focus

Financial accounting provides data and information to external parties. The focus is historical performance, documenting what has already happened in a business’s financial activities. It analyzes:

-

Equity

-

Assets

-

Revenue

-

Liabilities

-

Expenses

Using this data, external parties can then make decisions that will affect the organization's future.

On the other hand, managerial accountants deal with standards, KPIs, and projects inside the company. They must understand how the information and data apply to a specific group or department within the organization.

Managerial accounting analyzes an organization's performance using data related to:

-

Budgets

-

Sales

-

Expenses

-

Cashflow

-

Non-financial factors

Reporting Standards

Financial accounting follows the strict guidelines of the Generally Accepted Accounting Principles (GAAP) or International Financial Reporting Standards (IFRS). According to the U.S. Securities and Exchange Commission, GAAP are the accounting standards, conventions, and rules companies adhere to when assessing their financial results, including net income and how companies record assets and liabilities.

Managerial accounting, however, does not follow these rigorous standards, allowing for more flexibility and customization. Some organizations can have internally created rules and processes that managerial accountants follow.

Reporting Frequency and Timing

Financial accounting reports are typically made quarterly or annually to meet regulatory requirements and the needs of external stakeholders. These reports are often retrospective, reflecting past performance.

Managerial accounting, however, can be conducted more frequently—monthly, weekly, or even daily—to provide current data for quick decision-making. This ongoing reporting helps managers adjust strategies promptly when the business situation changes.

How Each Type of Accounting Supports Business Decisions

Whether external or internal reporting, it's important to understand how these two types of accounting help make decisions that help a business grow and succeed.

Financial Accounting

Financial accounting provides clear reports on a company's performance, revenues, risk management, and overall financial health.

Financial accountants generate reports that:

-

Evaluate a company's compliance or records

-

Prove financial status

-

Scrutinize a company's value

External stakeholders or regulatory bodies can use this information to assess how

an organization operates.

Managerial Accounting

Managerial accountants are often key leadership team members as they assist internal decision-makers. Based on their data, executives decide how to plan, control, and optimize the company's operations and financial health.

These decisions focus on specific departments or areas within the company and can affect:

-

Financial decisions

-

Revenue growth

-

Change management

-

Internal structure

-

Technology adoption

Managerial accounting data can also include non-financial data, providing an in-depth company view.

Education and Skills Needed for Each Path

At Our Lady of the Lake University (OLLU), the MS accounting program offers courses in both financial and managerial accounting. The program's primary goal is to combine accounting theory with real-world business and accounting scenarios through the use of analytical methods and processes, critical thinking, and accounting-related case studies.

Financial Accounting

If you are interested in pursuing a career in financial accounting, you must obtain a degree in accounting or any related field such as finance, economics, or statistics.

However, obtaining a bachelor's degree is just the beginning and not enough to advance in accounting. As a prospective financial accountant, you will be distinguished from the competition and improve your chances of advancement by continuing your education. For example, even though it's not required, a master's degree can result in quicker employment and job promotion.

In addition, make sure your education meets the minimal requirements to take the CPA certification exams:

-

A bachelor's degree

-

150 total hours of college education (undergraduate or graduate level)

It's also important for you to work on developing a specific set of skills. As a financial accountant you need to have the following set of skills:

-

Analytical skills

-

Excellent negotiation

-

Communication skills

-

Time management

-

Critical-thinking

Managerial Accounting

To begin your professional career in managerial accounting, you will need a bachelor's degree in finance, accounting, business administration, or economics.

While all of these degree programs provide the necessary knowledge that is immediately applicable in the workplace, you should seek to enroll in as many accounting electives as you can. Through these courses, you can become proficient in comprehending and presenting accounting and financial data in industry-standard ways.

These topics are presented from various professional viewpoints, so studying topics in non-accounting business specializations, such as business administration, finance, and economics, can develop your critical thinking and problem-solving skills.

In addition, many employers prefer or require certification; hence, you should consider gaining the Certified Management Accountant (CMA) credential. The only requirement to secure your CMA is a bachelor's degree from an accredited institution to meet the Institute of Management Accountants (IMA) educational requirements for CMA certification.

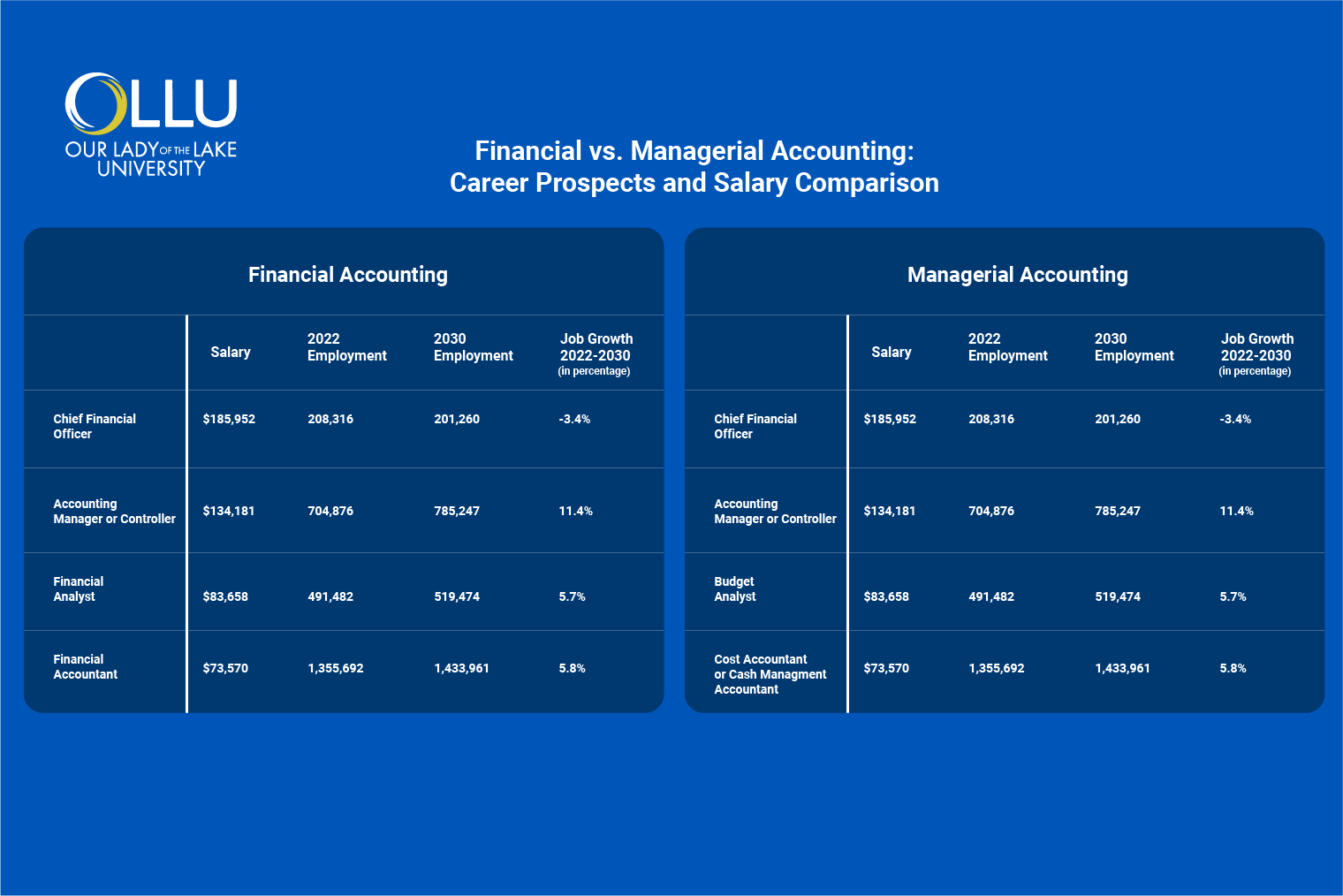

Career Prospects and Salary Comparison

The demand for the accounting industry is growing, and so is the need to fill the

various roles available under both managerial and financial accounting. Since there

are different career paths you can choose to pursue under each type of accounting,

we decided to share some of the top jobs in each category and their median salaries.

The demand for the accounting industry is growing, and so is the need to fill the

various roles available under both managerial and financial accounting. Since there

are different career paths you can choose to pursue under each type of accounting,

we decided to share some of the top jobs in each category and their median salaries.

Financial Accounting

Financial accountants generally command higher salaries due to regulatory demands and their roles in public-facing reporting. On average, they earn $79,880 annually, which can increase in large firms or after obtaining a CPA.

Financial accountants often face more demanding deadlines, especially during reporting periods, which affects their work-life balance and, consequently, their job satisfaction. However, many firms recognize the importance of flexible work arrangements to enhance employee well-being and productivity.

Managerial Accounting

Managerial accountants may start with a slightly lower salary but have diverse opportunities in different industries. They earn an average of $65,812 annually and have the potential for rapid growth, especially in larger corporations.

Managerial accountants tend to have more flexibility since their work is internally focused and often more project-based.

Which Type of Accounting Is Right for You?

Choosing between financial and managerial accounting comes down to your personal interests and career goals. Here are a few things to consider:

Do you prefer working with external stakeholders and following strict guidelines? Financial accounting may be for you.

Do you enjoy analyzing data to help companies improve their operations? Managerial accounting could be a better fit.

Think about the work environments you thrive in. Financial accounting tends to be more structured and rule-bound, while managerial accounting offers more flexibility and room for creative problem-solving.

Conclusion

Understanding the differences between financial and managerial accounting is crucial for anyone considering a career in accounting. Each branch plays a vital role in a business's success, and mastering both can open doors to various career paths.

The MS in Accounting program at OLLU enables you to provide critical financial data for internal strategic planning as well as external reporting purposes. The program also prepares you for eligibility to sit for the AICPA Uniform Certified Public Accountants Examination.

Frequently Asked Questions (FAQs):

What education or certifications are required for a career in accounting?

A bachelor’s degree in accounting or a related field is typically required. For financial accounting, a CPA certification is often needed, while managerial accountants may pursue a CMA certification.

Which is more challenging, managerial accounting or financial accounting?

It depends on your strengths. Financial accounting requires strict adherence to rules, while managerial accounting involves more flexible, internal decision-making. Both present unique challenges.